The 3 AM Wake-Up Call That Changed Everything

Sarah sat bolt upright at 3 AM, her heart racing. Another notification. Another overdraft fee. As a 32-year-old marketing manager earning $65,000 a year, she should have been fine. But between her $32,000 student loan balance, rising rent costs, and those “just one more” food delivery orders, she was hemorrhaging money without understanding where it all went.

Sound familiar? If you’re a millennial, there’s a 56% chance you’re dealing with the same financial stress Sarah faced. Recent data shows that over half of millennials report money as their primary source of stress, with 49% struggling to build emergency savings that could cover just three months of expenses.

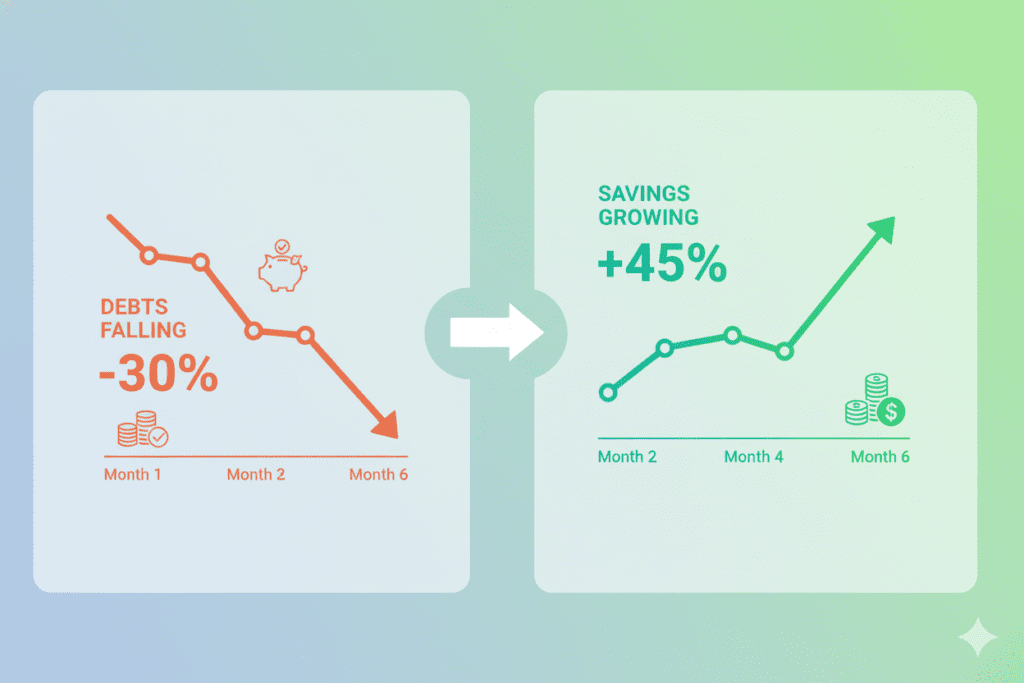

But here’s where Sarah’s story gets interesting. Within six months of discovering the best AI budgeting apps for millennials, she had saved $4,200, paid off two credit cards, and finally felt like she could breathe. The secret wasn’t earning more or living like a monk—it was leveraging artificial intelligence to work smarter with the money she already had.

Why Traditional Budgeting Fails Millennials (And What’s Different Now)

Let’s be honest: the spreadsheet your parents used isn’t cutting it. Millennials face financial challenges that previous generations never encountered. Research reveals that millennials hold only 5% of national wealth compared to Baby Boomers’ 21% at the same age. Factor in average student loan debt of $30,000, stagnant wages, and a cost of living that’s outpaced income growth by 30%, and you have a perfect storm of financial anxiety.

Traditional budgeting apps weren’t built for this reality. They expected you to manually categorize every latte, remember to log cash purchases, and somehow predict irregular expenses. No wonder 73% of budgeting attempts fail within the first month.

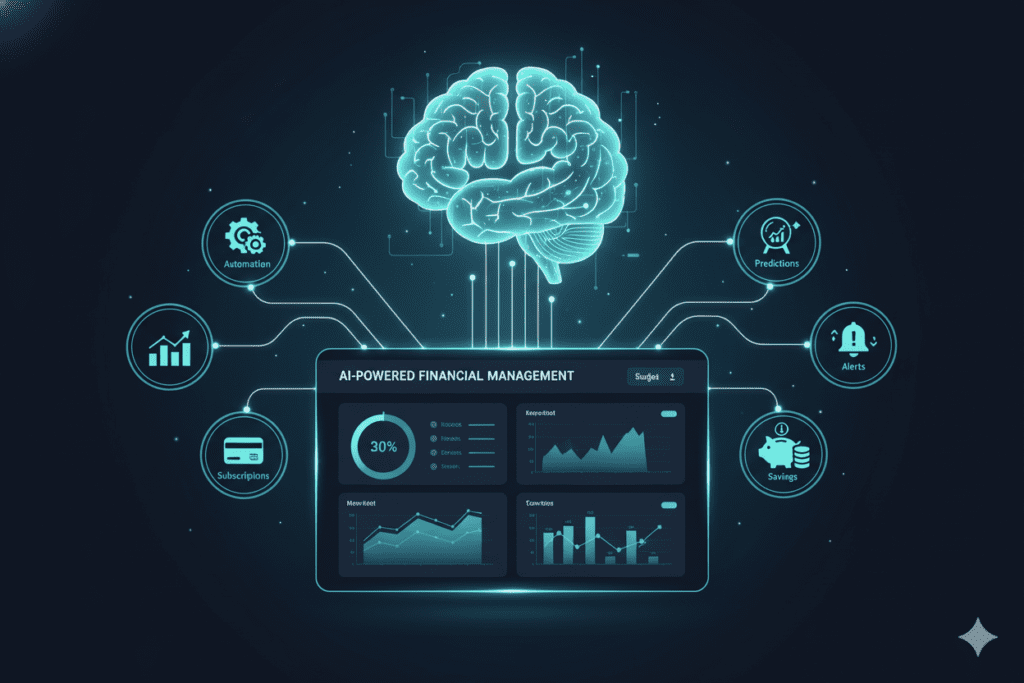

The best AI budgeting apps for millennials solve this by learning from your behavior patterns, automating tedious tasks, and providing real-time insights that actually change how you spend. These aren’t just digital calculators—they’re financial co-pilots powered by machine learning algorithms that get smarter every time you use them.

What Makes AI Budgeting Apps Actually Work

Before we dive into specific tools, let’s understand what separates effective AI budgeting apps from traditional options:

Automated Transaction Categorization: AI recognizes spending patterns instantly. That random charge from “AMZN MKTP” automatically gets categorized as online shopping, not miscellaneous.

Predictive Analytics: Machine learning forecasts upcoming expenses based on your history. It knows your car insurance is due next week before you do.

Behavioral Insights: AI identifies money-wasting patterns you’d never catch yourself. “You spend 3x more on takeout during stressful work weeks” isn’t judgment—it’s actionable intelligence.

Subscription Detection: Forgotten services drain accounts silently. AI hunts them down like a financial bloodhound, potentially saving $50-$100 monthly.

Smart Savings Automation: Instead of “save what’s left,” AI calculates exactly how much you can afford to set aside without impacting cash flow.

The Best AI Budgeting Apps for Millennials: Comprehensive Comparison

1. Cleo: Your Brutally Honest AI Financial Coach

Cleo isn’t just an app—it’s like having a financially savvy best friend who texts you when you’re about to make a terrible decision. This conversational AI learns your spending habits and delivers real-time feedback in a personality-driven way that makes financial management actually engaging.

Key Features:

- Conversational interface through text messaging

- Roast Mode (yes, really) that calls out bad spending habits

- Automatic savings challenges based on your capacity

- Subscription tracking and cancellation assistance

- Cash advance features for emergencies

Who It’s For: Millennials who need accountability with personality. If traditional budgeting feels like homework, Cleo gamifies the experience.

The Reality Check: Users report 15-20% more savings compared to traditional budgeting apps because Cleo makes it impossible to ignore your financial reality. When it texts “You’ve spent $340 on takeout this month—that’s 3x your usual,” that’s the wake-up call most millennials need.

Pricing: Free basic version; premium features $5.99/month

2. YNAB (You Need A Budget): The Zero-Based Budgeting Revolution

YNAB has become legendary among millennials for one reason: it forces you to give every dollar a job. Built on the zero-based budgeting methodology, this AI-enhanced platform uses machine learning to read spending patterns and automatically categorize transactions while identifying areas for improvement.

Key Features:

- Zero-based budgeting system

- AI-powered transaction categorization

- Goal tracking with progress visualization

- Real-time synchronization across devices

- Educational resources and community support

The Numbers: YNAB claims average users save $600 in their first two months and $6,000 in their first year. While individual results vary, the methodology combined with AI automation creates powerful accountability.

Who It’s For: Millennials serious about financial transformation who want structure combined with smart automation.

Pricing: $14.99/month or $99/year (34-day free trial; college students get 12 months free)

3. Rocket Money: The Subscription Assassin

Formerly known as Truebill, Rocket Money’s AI specializes in finding money you’re already losing. Most millennials discover they’re hemorrhaging $50-$100 monthly on forgotten subscriptions—streaming services signed up for during free trials, gym memberships never used, or that meditation app from New Year’s resolution 2022.

Key Features:

- AI-powered subscription detection and cancellation

- Bill negotiation service (the AI argues with companies for lower rates)

- Smart Savings feature with automated transfers

- Credit score tracking

- Spending analytics with category breakdowns

The Millennial Advantage: Rocket Money handles the tedious customer service calls millennials dread. No more waiting on hold or navigating cancellation websites designed to make you give up.

Who It’s For: Millennials juggling multiple subscriptions and tired of overpaying for services.

Pricing: Free basic features; premium $6-$12/month based on income

4. Copilot: The Premium Experience (iOS Only)

If you’re an Apple user willing to invest in the most sophisticated AI budgeting experience, Copilot delivers. This iOS-exclusive app learns how you spend money and refines its categorization automatically—meaning it gets genuinely smarter the longer you use it.

Key Features:

- Dynamic budget adjustments based on spending changes

- Rollover balances (doesn’t punish you for going over one month)

- Investment tracking including crypto and real estate

- Custom rules and tags for detailed tracking

- Beautiful, intuitive interface

The Premium Perspective: At $14.99/month, Copilot isn’t cheap. But users consistently report it’s worth the investment for the sophistication and time saved. The AI’s ability to adapt to your life changes—new job, moving, having kids—sets it apart from static budgeting tools.

Who It’s For: iOS users who view budgeting software as essential infrastructure, not optional expense.

Pricing: $14.99/month or $99/year

5. Mint: The Free Powerhouse

Intuit’s Mint remains one of the most comprehensive free AI budgeting tools available. While it may lack some premium features of paid apps, the AI-driven spending analysis and budget recommendations provide solid value for millennials just starting their financial journey.

Key Features:

- Free forever with all basic features

- Automatic transaction categorization

- Bill payment reminders

- Credit score tracking

- Investment performance monitoring

- Personalized financial tips

The Free Advantage: For millennials struggling to justify another subscription, Mint proves effective budgeting doesn’t require monthly fees. The AI analyzes spending patterns and provides actionable tips without cost barriers.

Who It’s For: Budget-conscious millennials who need comprehensive features without adding another monthly expense.

Pricing: Completely free (ad-supported)

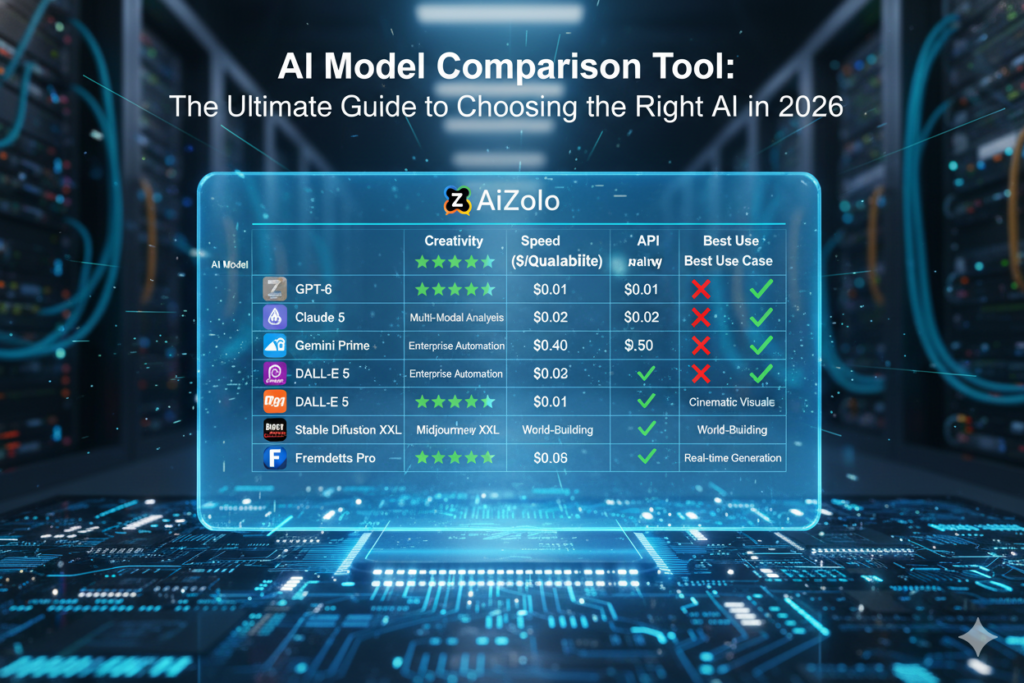

Beyond Traditional Apps: How AiZolo Changes the Game

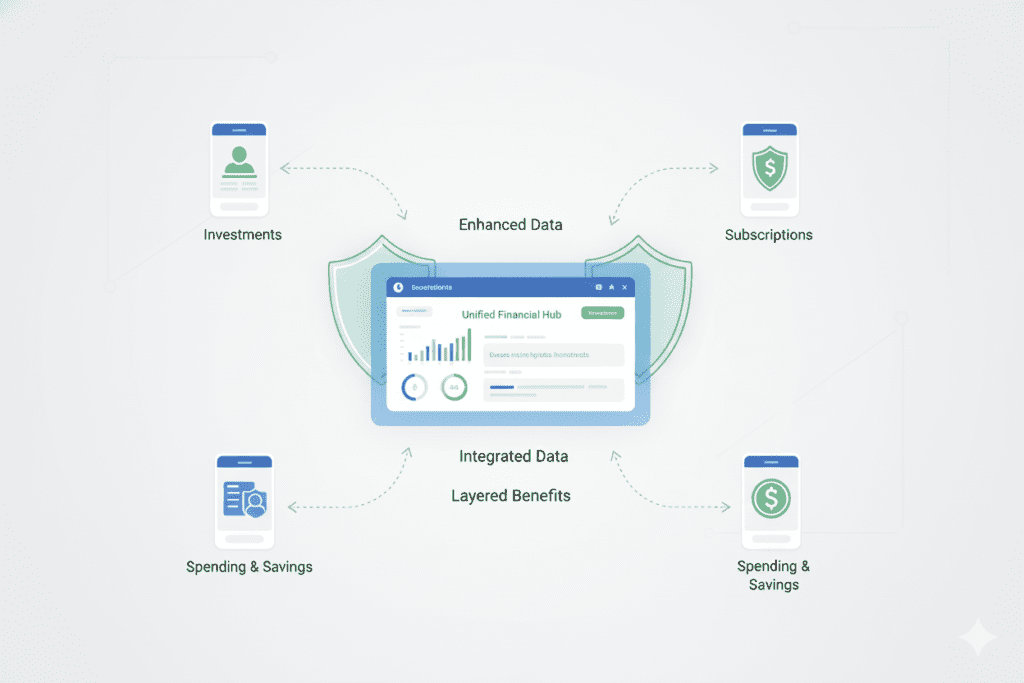

Here’s where things get interesting. While the apps above focus specifically on budgeting, savvy millennials are discovering that the biggest financial drain isn’t just spending—it’s paying for multiple AI subscriptions to manage different aspects of life.

Think about it: you’re paying $20/month for ChatGPT Plus to help with work, another $20 for Claude for research, $20 for Gemini Advanced, and suddenly you’re spending $100+ monthly just on AI tools. That’s $1,200 annually that could go toward emergency savings or debt paydown.

Enter AiZolo—an all-in-one AI subscription platform that gives you access to every major AI model (ChatGPT-4, Claude Sonnet 4, Gemini 2.5 Pro, Perplexity, and more) for just $9.90/month. That’s a 91% savings compared to subscribing individually.

How Millennials Are Using AiZolo for Financial Management:

Budget Analysis: Compare responses from multiple AI models to get diverse perspectives on your financial situation. Ask ChatGPT for creative budgeting strategies while Claude analyzes your spending patterns with detailed logic.

Side Hustle Development: Access premium AI tools to build freelance businesses without the premium price tags. One AiZolo subscription replaces five others, freeing up funds for business investment.

Financial Learning: Use different AI models to explain complex financial concepts from multiple angles. Learning about investing, tax strategies, or retirement planning becomes comprehensive and affordable.

Document Analysis: Upload financial statements to AI models for instant analysis and recommendations—a feature that would require expensive subscriptions to access individually.

The platform also includes project management features, allowing you to organize different financial goals with custom prompts. Create a “Debt Payoff” project with optimized AI assistance or a “Investment Research” workspace—all within one affordable subscription.

For millennials already using multiple AI tools for work and life optimization, consolidating subscriptions through AiZolo represents immediate monthly savings that compound over time. That extra $90/month saved equals $1,080 annually—enough to establish an emergency fund or accelerate debt paydown significantly.

Real Millennials, Real Results: Case Studies

Case Study 1: The Subscription Stack Overhaul

Marcus, 29, freelance graphic designer, Los Angeles:

Starting point: $67,000 income, $28,000 student loans, spending $180/month on various subscriptions

Action taken: Used Rocket Money to identify and cancel 7 forgotten subscriptions ($73/month saved), switched to AiZolo for AI tools (additional $90/month saved), used Cleo for daily spending accountability

Results after 6 months: Saved $978 from subscription optimization alone, paid off $4,200 in student loans, built $1,500 emergency fund

Marcus’s insight: “I thought I was being smart using all these tools to optimize my work. Turns out, I was optimizing myself into being broke. Consolidating through AiZolo and cutting subscription waste was the single biggest financial move I made this year.”

Case Study 2: The Behavioral Change Challenge

Priya, 31, software engineer, Austin:

Starting point: $92,000 income, $35,000 student loans, consistently overspending by $400-600/month despite good income

Action taken: Implemented YNAB’s zero-based budgeting, used Copilot’s rollover feature for flexibility, leveraged AiZolo’s multiple AI models to analyze spending patterns and generate personalized strategies

Results after 8 months: Eliminated overspending, saved $7,200, paid off $8,000 in highest-interest debt

Priya’s insight: “The AI didn’t judge me—it just showed me patterns I couldn’t see. Realizing I spent $450/month on impulse purchases during work stress was eye-opening. Now I have alternative strategies that actually work.”

Choosing the Best AI Budgeting Apps for Your Millennial Reality

Not all AI budgeting apps serve the same purpose. Here’s how to match tools to your specific situation:

If you’re drowning in subscriptions: Start with Rocket Money. The AI’s subscription detection often uncovers $50-$100 in monthly savings immediately, providing quick wins that motivate continued effort.

If you need structure and accountability: YNAB’s methodology combined with AI automation creates powerful habit formation. The upfront learning curve pays dividends through lasting behavioral change.

If you want personality with your finance: Cleo’s conversational approach makes budgeting feel less like deprivation and more like having a supportive friend. The engagement keeps you consistent.

If you’re an Apple ecosystem devotee: Copilot’s premium experience justifies its cost through sophistication and time savings. The AI genuinely improves with use, creating increasingly personalized guidance.

If you’re just starting out: Mint’s comprehensive free features remove barriers to entry. You can always upgrade later once you’ve established budgeting habits.

If you’re optimizing across multiple tools: Evaluate your total subscription spending. If you’re using multiple AI platforms for work, learning, or life optimization, AiZolo’s all-in-one approach might save more money than any budgeting app could recover through spending cuts alone.

The 30-Day Millennial Budget Challenge

Want to see real results? Here’s a strategic approach combining the best AI budgeting apps for millennials:

Week 1: Discovery Phase

- Install Mint (free) or your chosen budgeting app

- Connect all accounts and let AI categorize 30 days of historical transactions

- Use Rocket Money to audit subscriptions

- Identify your top three spending categories

Week 2: Optimization Phase

- Cancel unnecessary subscriptions discovered through AI analysis

- If using multiple AI tools, calculate savings from consolidating to AiZolo

- Set up automatic savings transfers based on AI recommendations

- Create realistic budget categories informed by actual spending patterns

Week 3: Implementation Phase

- Follow AI-generated budget recommendations

- Use real-time notifications to catch overspending early

- Adjust categories based on week 2 learnings

- Start one AI-suggested savings challenge

Week 4: Refinement Phase

- Review full month’s data with AI analysis

- Identify successful strategies vs. unrealistic restrictions

- Set sustainable long-term goals informed by real behavior

- Calculate total savings and extrapolate annual impact

Most millennials following this challenge discover at least $150-300 in monthly savings through subscription optimization, spending awareness, and smarter tool choices. That’s $1,800-3,600 annually—enough to make significant progress on debt or savings goals.

The AI Advantage: Why This Generation Gets It

Millennials are uniquely positioned to benefit from the best AI budgeting apps for several reasons:

Digital Native Comfort: Growing up with technology means less resistance to AI-driven solutions. Millennials understand that good AI gets better with use, creating patience for the learning curve.

Mobile-First Mindset: With 77% of millennials using mobile banking apps daily, AI budgeting integrates seamlessly into existing digital habits rather than requiring behavior change.

Subscription Economy Fluency: Having grown up with streaming services and SaaS, millennials understand the value of paying for tools that deliver results. This makes investing in premium features or optimizing subscription stacks natural.

Data-Driven Decision Making: Millennials trust data over intuition for major decisions. AI’s ability to surface patterns and provide evidence-based recommendations aligns with this preference.

Community Learning: Platforms like TikTok and Reddit mean millennials share financial strategies actively. Successful AI budgeting apps spread through social proof faster than any previous generation’s tools.

[Image prompt: Diverse group of millennials using phones with AI budgeting app interfaces visible, coffee shop setting, collaborative and tech-forward atmosphere]

Common Mistakes to Avoid

Even with the best AI budgeting apps for millennials, certain pitfalls undermine success:

Analysis Paralysis: Trying every app simultaneously creates confusion rather than clarity. Choose one primary tool, give it 60 days, then evaluate results.

Ignoring AI Recommendations: The algorithms work, but only if you act on insights. An AI telling you that food delivery costs $400/month means nothing if you don’t adjust behavior.

Unrealistic Restrictions: AI can calculate what’s mathematically possible, but sustainable change requires emotional buy-in. If a budget makes you miserable, you won’t stick with it regardless of how smart the algorithm is.

Neglecting Subscription Audits: Even while using budgeting apps, millennials often overlook the total cost of their tool stack. Regularly review whether you’re paying for multiple services that could be consolidated.

Short-Term Thinking: AI budgeting apps excel at long-term trend analysis. Checking only weekly defeats the purpose—monthly and quarterly reviews reveal transformational insights.

Advanced Strategies: Stacking AI Tools for Maximum Impact

Power users combine multiple AI tools strategically for compound benefits:

The Optimization Stack: Rocket Money for subscription management + AiZolo for work productivity + Mint for comprehensive free budgeting = maximum savings with minimal redundancy

The Intensive Stack: YNAB for strict budgeting methodology + Cleo for daily accountability + Copilot for investment tracking = comprehensive financial transformation (higher cost, maximum results)

The Starter Stack: Mint for budgeting + Rocket Money for subscriptions + AiZolo for productivity = complete solution under $20/month total

The key is ensuring tools complement rather than duplicate functions. AI subscription management, AI budgeting, and AI productivity serve distinct purposes—but paying for three separate ChatGPT subscriptions accomplishes nothing except draining your account.

The Future of AI Budgeting: What’s Coming Next

The best AI budgeting apps for millennials are evolving rapidly with new capabilities emerging:

Predictive Financial Planning: Next-generation AI will forecast life events and automatically adjust budgets. Planning to buy a house? AI will start shifting allocations 18 months in advance.

Voice-Activated Financial Management: Conversational interfaces will enable natural language budgeting adjustments. “Move $200 from dining to savings” will happen instantly through voice commands.

Cross-Platform Financial Intelligence: AI will analyze spending across all apps and services, providing unified insights regardless of where transactions occur.

Automated Negotiation: AI agents will negotiate bills, subscriptions, and even salaries on your behalf, optimizing income and expenses simultaneously.

Personalized Financial Coaching: Machine learning will deliver coaching that adapts to your personality type, stress triggers, and motivation patterns—not just your spending data.

For millennials willing to embrace these tools now, the advantage compounds over time. Early adopters develop financial literacy and habits that position them for long-term wealth building despite starting from behind previous generations.

Taking Action: Your Next Steps

The best AI budgeting apps for millennials only work if you actually use them. Here’s how to start today:

Step 1: Choose one primary budgeting app based on your specific needs and budget. Don’t overthink this—any of the apps covered will deliver value if used consistently.

Step 2: Complete a subscription audit. Use Rocket Money or manually review credit card statements for recurring charges. Cancel anything you haven’t actively used in 60 days.

Step 3: If you’re using multiple AI subscriptions for work or learning, calculate your total monthly AI spend. If it exceeds $30, evaluate consolidation through platforms like AiZolo.

Step 4: Connect all financial accounts to your chosen app and let AI analyze 30 days of transactions before making changes. Data-driven decisions beat gut feelings.

Step 5: Set one specific, measurable goal for the first 90 days. “Save $500 for emergency fund” or “Pay off $2,000 credit card debt” provides clear focus.

Step 6: Join millennial-focused financial communities on Reddit (r/personalfinance, r/millennials) or follow financial creators on TikTok. Social support dramatically improves success rates.

Step 7: Schedule monthly review sessions. Block 30 minutes to analyze AI-generated insights and adjust strategies. This single habit separates successful users from abandoned apps.

The Bottom Line: AI as Financial Equalizer

The best AI budgeting apps for millennials represent more than convenient tools—they’re equalizers in a financial landscape stacked against this generation. While millennials may have started with less wealth, higher debt, and more economic uncertainty than previous generations, they also have access to technology that makes sophisticated financial management accessible to everyone.

A millennial earning $50,000 with smart AI tools can now implement strategies that were previously only available through expensive financial advisors. The AI doesn’t care whether you have $500 or $500,000—it optimizes whatever resources you bring with equal sophistication.

The question isn’t whether AI budgeting works. Data from thousands of users proves it does. The question is whether you’re ready to leverage technology to overcome generational disadvantages and build the financial security previous generations took for granted.

Sarah, the marketing manager from our opening story, put it perfectly: “I spent years thinking I was bad with money. Turns out, I just needed tools designed for how millennials actually live. The AI didn’t change my income—it changed how effectively I used what I already had. That made all the difference.”

Ready to transform your financial reality? Try AiZolo today and experience how consolidating your AI subscriptions can free up hundreds annually while providing the tools you need for both work and financial success. Or explore AiZolo’s blog for more insights on optimizing your digital life while building wealth.

The best time to start was five years ago. The second-best time is right now. Your future financial security begins with the decision you make today.

Suggested Internal Links

- How to Save Money on AI Subscriptions – Place in the section discussing AiZolo and subscription consolidation

- Why AiZolo is the Best Value AI Subscription – Place after discussing multiple AI tool costs

- How to Chat with Multiple AI Models – Link when discussing using different AI for financial analysis

- Best AI Tools for Content Creation – Reference when discussing millennial side hustles and productivity

Suggested External Links

- Bank of America Better Money Habits Study – Place in statistics section about millennial financial challenges

- National Foundation for Credit Counseling – Link when discussing financial literacy resources

- Consumer Financial Protection Bureau – Budgeting Tools – Place in educational resources section

- NerdWallet Personal Finance Resources – Reference for additional budgeting education

- Investopedia – Zero-Based Budgeting – Link when explaining YNAB methodology